Facing a five-fold increase in his property taxes, a Woolwich landowner is looking to reverse that assessment call. So far, he’s had trouble getting as much as an explanation.

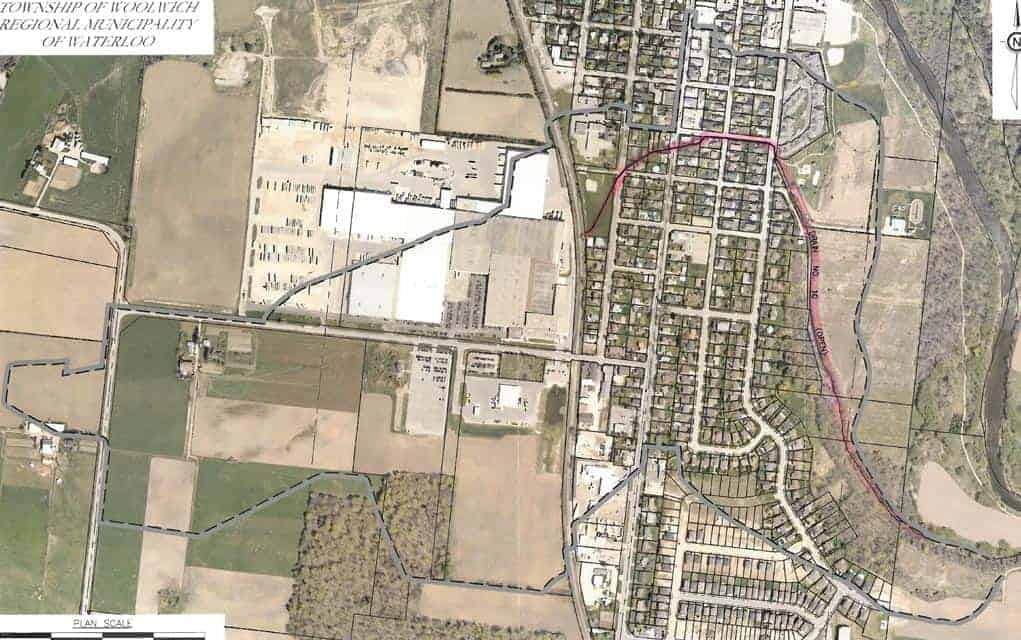

The Municipal Property Assessment Corporation notice received by Carlo Tucci applies to a 45-acre piece of farmland on Benjamin Road. The revised assessment changes to “residential” from “farmland” the property’s 15 acres of brush and trees, sending the taxes soaring.

“MPAC tells me they can’t designate it as farmland because the 15 acres is not farmland and the only designation they can assign the acreage is residential,” he explained. “ Now here is the truly insane part: the land is inaccessible because it’s landlocked on all sides and the rear, and the only way to get to it is through the 30 acres of farmland with its crops.”

The distinction between the farmed land and the woodlot has never been an issue, he added, noting he’s not alone in dealing with the reassessment and higher taxes.

“I’ve never had a problem since I bought it in 1998,” he said of the land and its tax designation.

Richard Petherick, Woolwich’s finance director, says Tucci’s is not an isolated case. While the township is sympathetic, it is powerless to change the tax-rate classification set by MPAC.

“The township can only bill on what MPAC information we have,” he explained, adding the only clarification he’s heard is that as woodlots are not deemed farmland, they become subject to the residential rate.

“Residential is essentially a default assessment.”

As it stands, property owners in Tucci’s situation can appeal to MPAC for a reassessment, Petherick noted. If that fails, there are further legal steps.

MPAC has not acknowledged the extent of the problem, though in a statement it pointed to the appeal process.

“MPAC conducts ongoing reviews to ensure farm properties are accurately assessed and corrections are made where necessary. A review of a farm property could be triggered from ongoing data verification, updated tenant information, sales investigations, building permits and severances which may result in changes to the valuation or classification of a farm property, including wooded acreage,” Karen Russell, the agency’s director of valuation and customer relations, said in an email to The Observer.

“We are committed to working with property owners who may be part of the review and we will work with them to resolve any questions or concerns they may have.”

Tucci has been in touch with officials, including local MPPs and the township, but so far has not heard anything assuring about the situation he and others face.

At a time of heightened environmental sensitivities, he points out the irony that owners of woodlots could avoid the tax hit by clear-cutting the trees and converting the land to farming.

“I don’t want to do this because I want to preserve the ecosystem in the back, as the acreage is part of a larger forested area. So I am stumped, and others will be in the same position. I believe MPAC has erred and should reassess it as all farmland or reduce the value of the forested area so it has little or no impact on the new taxes,” he said.

In his case, it’s not as though the land deemed “residential” can be used for that purpose – it’s still zoned strictly for agricultural use. His property contains no buildings, but is simply used for farming on the accessible portions.